In This Issue…

• Reciprocal deposits: S. 2155 changes the landscape

• ADA website accessibility

• Marijuana and SQ 788

• Annual Washington Visit scheduled

• Oklahoma Bankers Hall of Fame taking nominations for inaugural class

• Oklahoma Public Resource Center requests proposals

• OBA education corner …

Reciprocal deposits: S. 2155 changes the landscape

As we’ve noted in this space before, S. 2155 – the Economic Growth, Regulatory Relief and Consumer Protection Act – contains a number of provisions designed to help community banks better serve their customers. One of the provisions amends the Federal Deposit Insurance Act to clarify that most reciprocal deposits will no longer be considered as “brokered.” What this means is your bank can increase its use of reciprocal deposits to grow deposits, attract high-value relationships, and make more funds available for local lending.

Competition is expected to tighten . . . especially for retail deposits. Rates are expected to rise. Yes, you have your challenges. But, as always, we’re here to help you.

The Oklahoma Bankers Association was part of a collective effort to get S. 2155 passed and signed into law. We all worked very hard – over a period of more than 5 years – toward this goal, and we were successful.

As a result of our collective effort, most reciprocal deposits will no longer be treated by regulators as “brokered.”

But . . . what exactly are reciprocal deposits? Generally speaking, they are deposits a bank receives through a deposit placement network in return for placing a matching amount of deposits at other network banks.

The Promontory Network actually invented this idea some 16 years ago and today it is the largest provider of “reciprocal deposits” in the nation. A number of years ago, the OBA endorsed Promontory because the Board believed this product would be helpful to smaller community banks, which make up the vast majority of OBA members.

A problem developed during the last administration which viewed these “reciprocal deposits” as “brokered” deposits. S. 2155 changes that classification and we want to make sure you’re aware of those changes.

Promontory will soon provide informational webinars dealing with reciprocal deposits, how they work and how they will benefit your bank. Using reciprocal deposits enables you get to keep your customer’s entire deposit on your bank’s books, fending off the competition for those excess deposits from other financial institutions, including nonbank and “Fintech” firms with whom you compete daily.

We think now is the time to use reciprocal deposits to lock in more low-cost funding and to build more large-dollar relationships. Now is the time to grow in profitability and in size. Try reciprocal deposits. They are at work for thousands of banks around the country. They can work for you.

Today, roughly half of the banks in the country are members of Promontory Network Promontory Interfinancial Network, LLC. Click here for registration details on Promontory’s informational webinars on CDARS.

To learn more, you can also visit www.promnetwork.com or contact Chuck McBrayer at (866) 776-6426, ex. 3432 (cmcbrayer@promnetwork.com).

ADA website accessibility issue continues

Over the past few months we’ve been hearing rumors about an increase in “demand” letters being sent to banks for alleged violations of the Americans With Disabilities Act. Some lawsuits have been filed in which it is asserted the ADA requires compliance with a specific website accessibility standard for vision-impaired consumers.

Many of these lawsuits are being filed against banks by opportunistic plaintiffs’ lawyers purportedly acting on behalf of disabled consumers. The lawsuits allege noncompliance with Title III of the Americans with Disabilities Act (ADA), but the problem is the courts have not definitively determined that Title III of the ADA even applies to websites. Why? Because the law was written before the Internet came into existence.

Moreover, the Department of Justice (DOJ) – which in the past administration asserted that the ADA does apply to websites – will not adopt a website accessibility standard through a rule-making proceeding. With that reality in mind, it’s just a bit odd that these lawsuits are being filed in good faith when there is no official, government-issued standard with which banks or anyone else must comply.

The DOJ’s inaction has encouraged a growing number of law firms purportedly representing disabled plaintiffs to target businesses of all sizes. What this means is that regulation of websites under Title III of the ADA has been ceded to trial lawyers and judges. What’s worse, courts are all over the map – some say the law does not apply to websites while other courts rule to the contrary.

If your bank receives such a demand letter or litigation threat, please let us know so we can continue to collect data to support our effort to resolve this issue through legislation or otherwise.

Marijuana, SQ 788 questions abound

As you probably know by now, State Question 788 is on the ballot for the June 26th election, which is just a couple of weeks away. The OBA has joined the business community in general to oppose SQ 788, but the proponents continue to make their case around the state.

Some bankers say they are not banking marijuana. But – Are they sure about that? You might be surprised – by BSA/AML issues that are presented on this general subject, and especially if SQ 788 is approved by the voters.

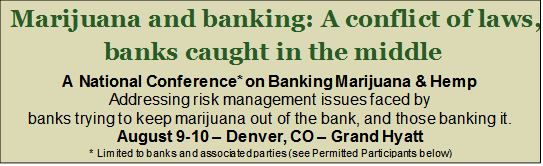

The OBA is working with the Colorado Bankers Association in providing information about the general issue of “banking” the marijuana business, either directly or indirectly. You can learn about marijuana risk management at a risk-management program noted here:

Regardless of whether SQ 788 is approved, that does not mean the issue goes away for banks. And the problem is that the rules governing the issue generally are somewhat chaotic and confusing at best, even if SQ 788 is defeated, but especially if it passes.

Why do we say that? Primarily because there have been mixed signals coming from the Administration, Congress, regulatory agencies and the courts.

In the 30 states that have legalized medical or adult-use marijuana, and the additional 15 states that permit cannabinoid oil for medicinal purposes, state-legal activities dealing with marijuana use of any kind still violate federal law.

If you or your bank want to learn more about the dangers and the appropriate tactics of which banks must be aware, the Seminar noted herein may be of interest to you, especially if SQ 788 is approved by the voters.

We may be premature in bringing this program to your attention because SQ 788 may not be approved. But that does not end the inquiry about “banking” any kind of marijuana business.

For more information, please go to Marijuana Banking Aug 9-10 Denver. Click here for registration details.

Annual Washington Visit scheduled

The OBA’s Annual Washington Visit has been scheduled for Sept. 30-Oct. 2 and the hotel will be the Marriott Marquis Washington D.C.

Registration information should be hitting your bank shortly, but you can also download the registration and information form, and get more info on the hotel, by clicking here.

If you have any questions, contact Adrian Beverage at the OBA.

Oklahoma Bankers Hall of Fame taking nominations for inaugural class

The Oklahoma Bankers Hall of Fame has been created by the OBA Board of Directors to honor individual bankers for their contributions to the banking industry and the State of Oklahoma.

In addition, the Hall of Fame is intended to recognize bankers’ achievements on behalf of the Association’s member banks. Click here for more information and the nomination form.

Oklahoma Public Resource Center requests proposals

Oklahoma Public Resource Center envisions a quality education for every child in Oklahoma, and their mission is to drive transformation and increased academic achievement within Oklahoma’s public education system. OPSRC membership is open to all public schools in Oklahoma; however, they are particularly focused on meeting smaller schools’ and districts’ needs. These entities typically lack a large central administrative office found in larger districts, so OPSRC’s services are tailored to help address the challenges they face.

On behalf of members schools, OPSRC requests proposals from financial institutions for a purchasing card (p-card) program and system. Click here for to view the request for proposal. The intended result of this program would create increased efficiency and revenue with a cash back incentive for participating member schools. Currently, OPSRC has 200+ members.

Fore more information, contact Megan Stanek at (405) 926-8322 x108 or megan@stanek@opsrc.net.

OBA education corner …

The OBA Convention is in the books and summer is upon us! While live seminars take a break during the upcoming months, our webinars NEVER do! Take note of the following:

- Notary Public, June 19, webinar — Being a notary public is a responsibility assumed by many financial institution employees. Unfortunately, most do not understand the personal liability when agreeing to serve in this capacity.

- RESPA – Those Pesky Section 9 Violations, June 19, webinar — Every financial institution has violations of Section 8. How serious are your violations? You need to be aware of your violations and take steps to eliminate them.

- BSA Series: 10 Examination Hot Spots, June 20, webinar — During this webinar, we will look at the top exam issues for 2018 and focus on avoiding the mishaps of poor planning on your examination.

- Residential Construction Lending, June 25, webinar — This program provides an overview of the major issues involved in consumer or residential construction lending, primarily to individuals having a home built or remodeled.

- Commercial Real Estate Lending: Property Types, Lease Structures and Other Non-Financial Risks, June 26, webinar — Commercial lenders, credit analysts and small business lenders, consumer lenders, mortgage bankers and private bankers; loan review specialists, special assets officers, lending managers and credit officers should tune into this webinar.

Oklahoma Bankers Association We make bankers better!

Oklahoma Bankers Association We make bankers better!