In This Issue…

• 9/11 remembered today

• Community Banker Advisory Council restructured; Oklahoma bankers’ applications rejected

• Impact of new HMDA data: What does it mean?

• OBA education corner …

9/11 remembered today

Seventeen years ago today, the OBA’s Annual Washington Visit was in full swing. About 50 bankers were with the OBA’s officers and staff helping to make the case for the industry with members of the Oklahoma delegation and federal banking regulatory agencies.

The OBA’s visit was combined with the State Chamber’s annual visit and the large group was gathered on the top floor of the Hart Senate Office Building and waiting for the arrival of Sen. Don Nickles.

“A few of us, including (State Banking) Commissioner (Mick) Thompson, were standing on the west side of the top floor just looking out the window as we visited about various things,” OBA President and CeO Roger Beverage said. “All of a sudden, there was this huge fireball and black smoke like it’s shown in the  picture here. We had no idea at the time what had happened in New York, but when Sen. Nickles arrived, I immediately went over to him and brought him to the window.

picture here. We had no idea at the time what had happened in New York, but when Sen. Nickles arrived, I immediately went over to him and brought him to the window.

“‘I don’t know what just happened, but you need to see this. It’s bad, whatever it is,’” Beverage said to Nickles. “Moments later, his son called from London to tell the senator to get out of the building and that we were under attack.

“We all looked around and soon understood the danger presented. Rumors abounded fueled by what we thought were explosions but which were fighter jets breaking the sound barrier. We left the Hart building and walked out into massive chaos.”

Today, we honor those who perished that day at the hands of jihadists who are still intent on bringing more chaos to the United States and our way of life.

Community Banker Advisory Council restructured; Oklahoma bankers’ applications rejected

Earlier this year, the Bureau of Consumer Financial Protection fired the 19 members of the Community Banker Advisory Board created during the Richard Cordray era as required by Dodd-Frank. The Bureau then tried to re-create a smaller group in an effort to bring in more diverse views and exclude national advocacy organizations.

The restructured CBAB is much smaller – seven members compared to 19 members when it was originally created. The Board’s new members are as follows:

1. Erik Beguinis Founder, CEO, and president of Austin Capital Bank, a community bank and fintech innovator. He founded the bank to serve the needs of low- and moderate-income communities and develop unique products that help consumers retain and grow household wealth. Prior to founding Austin Capital Bank, he helped develop a commercial payments platform that was acquired by Bank of America and held positions with Procter and Gamble and KPMG. Beguinis is a member of the Community Depository Institution Advisory Committee for the Federal Reserve Bank of Dallas.

2. Bryan Bruns, currently serves as president and CEO of Lake Central Bank in Annandale, Minnesota. Lake Central is a 125- year-old, $150-million bank, with three offices located in central Minnesota, which offers a full range of banking, insurance and investment products. In addition to his 30-plus years of community banking experience, Bruns is active in both the banking industry as well as his community. He is a member and past chair of the Minnesota Bankers Association and continues to serve on its Government Relations Committee. In addition, he currently serves on the Administrative Committee of the American Bankers Association’s Community Bankers Council and is a member of the Financial Services Advisory Committee for U.S. Congressman Emmer.

3. Maureen Bush serves as vice president, compliance and CRA officer at The Bank of Tampa, a $1.7 billion community bank. In this role, she is responsible for the bank’s regulatory compliance program. She has over 25 years of experience in bank regulatory compliance, consumer reporting compliance for a nationwide specialty consumer reporting agency and risk management.

4. Michael Henry Head has worked for First Federal Savings Bank since July 1980. He started as a management trainee and has held the positions of branch manager, loan officer, lending department manager, COO and was named president in October 2000. He was named president and CEO on July 1, 2004. He served as chairman of the Indiana Bankers Association in 2016 and as a board member since 2008.

5. Aubery L. Hulings is the vice president, operations manager of The Farmers National Bank of Emlenton. She is a member of the Mortgage Bankers Association, treasurer of the Knox Civic Club and board member of Keystone SMILES.

6. Heidi Sextonis is executive vice president, COO responsible for oversight of information technology and security, compliance, enterprise risk management, and project management for Sound Community Bank (Washington State) in 2007.

7. Jeanni Stahl currently serves as MetaBank’s senior vice president, chief risk officer where she has responsibilities for overseeing a large network of innovative payment and lending products offered through nationwide delivery channels. She worked as a senior bank examiner at the FDIC for eight years, joining MetaBank in 2009.

Two Oklahoma bankers – Amada Alvidrez, president, Equity Bank, Guymon; and Alicia Wade, COO, Valliance Bank, Oklahoma City – applied to serve on the restructured CBAB but were not among the seven appointees.

“Both of these young women were outstanding applicants,” OBA President and CEO Roger Beverage said. “Either or both of these exceptional professionals would have been a wonderful addition to the (Community Bank Advisory Board), but I know that Director Mulvaney is committed to reducing the size and activities of these sub-groups mandated by Dodd-Frank.”

Beverage noted he would continue to support efforts by these young professionals to engage on behalf of their industry.

“It won’t be long before the torch is ultimately passed to the next generation of banker leaders,” Beverage said. “And I’m betting that these two women will be among those who favorably represent the industry. I invite other young bank professionals to reach out and find a place where they can fit and serve their industry in order to make it better for themselves and their customers and communities.”

Impact of new HMDA data: What does it mean?

(Courtesy of Arnold & Porter and Charles Rivers Associates, Washington, D.C.)

This afternoon, we listened to a presentation on fair lending and CRA issues and how the new HMDA data collection requirements might impact those two issues for member banks. The Washington law firm of Arnold & Porter, along with Charles Rivers Associates, walked us through some of the key issues of concern, and we wanted to pass them along to you right away.

Here are some of the basics:

- Lenders are to collect the new data required by the rule for loan actions on or after Jan. 1, 2018.

- Lenders will need to report this data by March 1, 2019, using the CFPB’s web-based submission tool for HMDA data reporting.

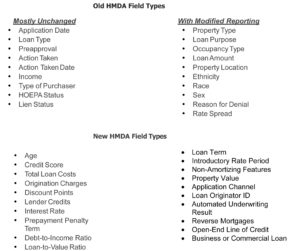

- Lenders are now required to collect and submit as many as 110 data fields for each HMDA reportable application vs. 39 previously.

- The new rule more than doubles the types of applicant and loan characteristics that must be reported (e.g., loan purpose, property location, race/ethnicity, credit score).

- In addition, the new rule requires more detailed reporting for many of the types of applicant and loan characteristics that were submitted previously.

- The CFPB currently intends to release this data to the public in some form as soon as late-March 2019.

The point for your bank: These changes will enhance your fair lending risk. For example, age is now a standard reporting field that will be reviewable going forward and following implementation of the new standards.

In addition to performing regular monitoring of pricing, underwriting and redlining risk, more is required. You must consider all relevant pricing and underwriting factors. In analyzing application and lending volumes vs. peer institutions, lenders should also consider performing separate assessments to identify anomalies observable from the expanded data fields and be ready to address and explain them prior to third parties’ access to publicly available expanded data fields.

If you undertake this kind of review, it’s also important to consider using outside counsel because of the attorney-client privilege it brings to the process! Bring in independent folks other than bank personnel to conduct this separate assessment.

In addition, it’s important that you understand what you’re doing today, not after the fact. You will have to be out in front of potential problems before they manifest themselves.

Here are some of the key points to understand:

OBA education corner …

Schools have started and so has football, so it feels summer is nearing an end, even if the weather outside doesn’t necessarily agree. One thing that is ending, though, is the usual summer respite from live seminars and events from the OBA’s education department. Many things are on the horizon! Take note of the following:

- Best-Ever Compliance Checklists for Commercial Loans, Sept. 17, webinar — We tend to think of business and agricultural loans as exempt from troublesome compliance requirements. But several compliance-related laws apply to commercial loans as well as consumer loans.

- Right of Setoff, Sept. 18, webinar — Do you know when the right of setoff is allowed and when it isn’t? Do you know if your financial institution has a statutory or contractual right of setoff? Do you understand the financial risks of using your setoff rights incorrectly? If you don’t know the answers to these questions, make sure to attend this valuable webinar.

- Ability to Repay/Qualified Mortgage Rules, Sept. 18, webinar — The program helps you decide whether changes are needed or if the status quo is acceptable.

- Residential Construction Lending, Sept. 20, webinar — Many problems can occur during construction that can leave lenders highly exposed unless they are unwritten properly. Understanding the risks in this type of lending is paramount for bankers. This course is designed to provide fundamental and proven techniques to minimize these risks.

- Incident Response and Forensics, Sept. 21, webinar — Prevention is our primary focus in protecting our institutions, but how would we know if we failed to prevent an attack? Knowing what threats are realistic for your institution and how to detect them is a challenging task.

- These People Drive Me Crazy, Sept. 26, webinar — Some days it just does not pay to get out of bed! Ever said that? Most of us that supervise others find there are just some people that can drive us crazy! This program will provide you with excellent coaching tactics on dealing with the challenging people issues that frequent the workplace.

- FFIEC CAT vs. InTREx, Sept. 28, webinar — These two programs have two different objectives, InTREx is used to conduct an examination against the institution where the FFIEC Cybersecurity Assessment Tool (CAT) can be both an examination tool and a self-assessment tool. Both provide extreme value to an institution when used properly. In this presentation, we will review both processes; best practices using each, comparison of their differences and how to leverage them together.

- 2018 OBA Consumer Lending School, Oct. 1-5, Oklahoma City — The total program of this school exposes students to major issues consumer credit managers face. It provides a framework for examining a bank’s consumer credit programs, policies and procedures.

- 2018 Advanced New Accounts Seminar, Oct. 10 – Tulsa; Oct. 11 – Oklahoma City — You have the basics under your belt. It’s time to tackle the next level. We will break down the requirements and translate the legalese. We’ll make sure you know what laws and rules apply and what they say. You will learn not only what you need to do, but why and when.

- 2018 Technology Conference, Oct. 25, Oklahoma City — Spend an informative, education-filled day and gain relevant, timely information and industry best practices for your technology risks and challenges.

- 2018 Real Estate Lending Compliance Seminar, Oct. 29-30, Oklahoma City — This two-day program provides an overview of the real estate lending requirements from 10 regulations, along with comprehensive coverage of selected topics, policy suggestions, and employee training tips, audit techniques and steps to eliminate past problems.

- 2018 OBA Operations School, Nov. 12-16, Oklahoma City — Operations School is designed to prepare junior-level officers to mid-level operations managers to manage effectively and efficiently an operations function within a bank. Students are exposed to numerous concepts that impact your bank’s bottom line.

Also, join the OBA in partnership with the Federal Reserve Bank of Kansas City and Community Bankers Association of Oklahoma for the second annual Banking and the Economy: A Forum for Women in Banking. The Forum, set for Oct. 24 at the Embassy Suites in Norman, is designed to provide senior level and high potential middle management women bank leaders with industry, leadership and professional development knowledge that will enhance their careers and networks. Don’t miss your chance to be part of this important conversation! Registration is $100. Please register soon, as previous conferences have sold out and space is limited.

Additionally, insights about trends and expectations regarding agriculture and rural economies will be the focus of the Rural Economic Outlook Conference taking place Oct. 17 on Oklahoma State University’s Stillwater campus. Click here for more information and to register online.

Finally, bankers are encouraged to attend a speech from OU Regent Frank Keating, former governor of Oklahoma and former CEO of the American Bankers Association, titled “How Bankers Can Help the Politicians.” The speech will take place on Sept. 27 at the Gene Rainbolt Graduate School of Business in Oklahoma City. There is no registration fee to attend, but seating is limited. For more information and to register, please visit price.ou.edu/obacfs by Sept. 20.

Oklahoma Bankers Association We make bankers better!

Oklahoma Bankers Association We make bankers better!