In This Issue…

- From Adrian’s desk …

- Jackpotting problem continues

- OBA dues invoices to be sent later this week

- Deposits at all institutions should be treated equally

- Holiday closing signs available for banks

- OBA TikTok Time …

- OBA education corner …

From Adrian’s desk …

By Adrian Beverage

OBA President & CEO

Just some random tidbits that might be of interest to our bankers this week!

• • •

I’m in New York City right now, at the ABA Annual Convention. We’ve already heard from some great speakers, including Adena Friedman, chair and CEO of Nasdaq, Inc.; Mark Milley, the former chairman of the Joint Chiefs of Staff; and Jamie Dimon (in photo at right), chairman and CEO of JPMorganChase. Today, we’re going to hear from Mike Allen, co-founder of Axios, who will join ABA President and CEO Rob Nichols to discuss the latest in the upcoming elections, and we’ll end the convention with a presentation from Secretary of the Treasury Janet Yellen.

• • •

Speaking of the upcoming elections, we’re a week away!

• • •

Last week, we shared a message about how we feel ALL our banks should be treated equally, when it comes to deposit insurance and protecting depositors. If you didn’t get a chance to see it, you can read it below in this issue of the OBA Update.

With the closure of First National Bank, in Lindsay, we felt it was apropos timing to share our thoughts on the issue.

• • •

Man, I really thought Nebraska was going to pull off the big upset at Ohio State on Saturday. Heck, I thought for a moment the Sooner would pull the big upset at Ole Miss. Neither happened, whomp, whomp, and down the road both teams move, both looking for more wins to become bowl eligible. Jeez, just saying that makes me realize how far both teams are from the heady days of 2000.

Jackpotting problem continues

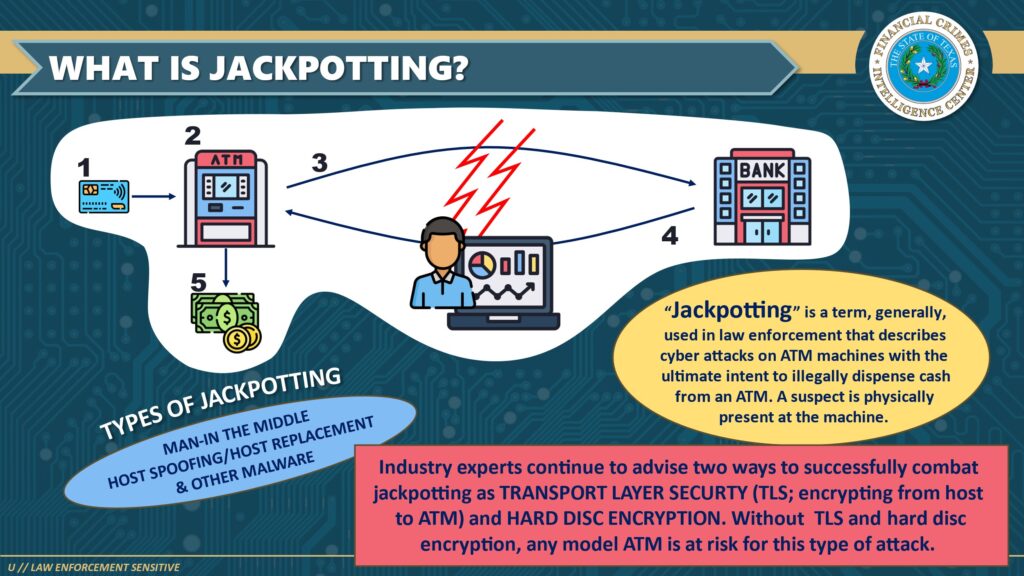

We wanted to pass along another warning to our banks about how ATM jackpotting continues to be a problem in our area of the country and remains a serious threat.

Jackpotting is gaining traction as ATMs in Van Buren, Arkansas, and Alma, Arkansas, were hit on Saturday These attacks allow the suspect to dispense cash from the ATM, without using a card, until the machine is empty.

Below is a graphic to help understand more how jackpotting works.

OBA dues invoices to be sent later this week

Just a quick little message to let our members know invoices for our annual dues will be sent out at the end of this week.

Each bank CEO, as well as the bank’s cashier, will receive a copy of the invoice.

If you have any questions, don’t hesitate to drop us a line!

Deposits at all institutions should be treated equally

The recent failure of First National Bank, in Lindsay, while tragic, brought an important issue to the forefront of our industry, particularly here in Oklahoma.

With previous bank failures in recent years, all depositors were eventually made whole – which also included those over the current $250,000 FDIC limit. With the failure of the Lindsay bank, however, the FDIC has shown that process is no longer standard.

Upon the Lindsay bank’s collapse, the FDIC immediately paid only 50% of uninsured deposits, while putting together a plan to hopefully make those customers whole again. It creates an opportunity to restart the conversation with our elected officials that we need to have a more reliable strategy in such instances for all banks, regardless of size.

A clearer and more consistent policy would ensure fairness and, most importantly, reassure trust and stability in the entire banking system.

The OBA will continue to have discussions with regulators and elected officials to make sure all banks and bank customers are treated fairly and equally, regardless of the size of the financial institution. Additionally, we are working closely with the Oklahoma State Banking Department. Commissioner Mick Thompson has been in constant contact with our federal regulators and members of our Washington, D.C., delegation regarding this issue.

Again, while the failure of the Lindsay bank is a tragedy for all involved, we hope it sparks a nationwide call to action for meaningful reform in the realm of fairness and consistency of deposit insurance.

Holiday closing signs available for banks

Customers need to know that Oklahoma banks are closed in observance of several holidays each year.

The OBA makes this easy by offering member banks a set of 12 decorative 6”x 9” decals. Static-cling decal signs clearly notify customers of your holiday closings. Each decal has a holiday design with the bank closing dates as observed by the Federal Reserve. Additional blank decals are provided to write on for emergency closings. Juneteenth holiday sign included. English edition or English/Spanish edition available!

OBA TikTok Time …

Welcome to the continuation of our semi-regular feature in the OBA Update: OBA TikTok Time!

The OBA created a TikTok account to feature fun, entertaining little video segments that feature our bankers and those who work with them. No, you don’t have to have a TikTok account to view these short videos as you can navigate directly there just by using the link we provide here in the OBA Update. For those concerned about security via TikTok, you can also easily view the videos through our Instagram account.

We’ll feature our most recent TikToks each week in the TikTok Time of the OBA Update. For this week’s edition, we had a bit of fun with our OBA board members before the most recent meeting last week, and had a few of them autograph some retro photos of themselves … photos they weren’t expecting to see! The reactions were priceless! (And don’t ask how we dug up these old photos … it’s our little TikTok Time secret! 🙂

OBA education corner …

“Steve Earle.” It’s a name we haven’t heard in a long while, but it popped up in a throwaway comment from a character in a Stephen King short story one of us here at the OBA recently read. Thus, some of us went on a dive through his catalog: Goodbye Is All We’ve Got Left, Copperhead Road, Nowhere Road, and his magnum opus, Guitar Town. Earle never really reached the heights he deserved back in the late 80s and early 90s, but it doesn’t mean it’s not too late to enjoy his songs now. It’s also not to late to think about what upcoming continuing education opportunities are right for you and your staff!

- 2024 IRA Basic and Advanced Issues, Basics: Nov. 5-Tulsa, Nov. 7-Oklahoma City; Advanced: Nov. 6-Tulsa, Nov. 8-Oklahoma City — The IRS has published final RMD regulations with a Jan. 1, 2025 effective date! The finalization of these highly anticipated regulations has a profound impact on IRA providers nationwide.

- 2024 Call Report Common Exam Issues, Nov. 6, webinar — Just recently in September 2024, the Office of the Comptroller of the Currency announced areas of supervisory priorities for 2025 that include allowance for credit losses, asset and liability management, and capital.

- Loan Documentation for Ag Lenders, Nov. 6, webinar — This webinar will provide financial institutions with an essential understanding of agricultural collateral, the risks presented by agricultural lending, agricultural loan documentation and loan administration.

- Wire Transfer Compliance, Nov. 7, webinar — Learn the steps you can take to protect your institution and your account holders!

- 2024 Fair Lending Update, Nov. 8, webinar — This session will go in-depth with a discussion of the new expectations and priorities so you can ensure your program is up-to-date and ready for your next exam.

- 2024 Performing Commercial Evaluations, Dec. 4, Oklahoma City — Tailored specifically for internal bank members responsible for reviewing or conducting commercial evaluations, this course provides a robust framework for mastering the intricacies of property evaluation.

Finally, just a quick note to mark your calendars as the OBA Convention and OBA Senior Management dates and location have already been set for next year! The 2025 OBA Convention will be held May 12-14, back at the Skirvin Hilton in Oklahoma City. Meanwhile, the 2025 OBA Senior Management Conference will be held on April 6-8 at the Renaissance Esmeralda Resort and Spa in Indian Wells, California. More details will be available in the coming months, but go ahead and get those notes on your calendar today!

Oklahoma Bankers Association We make bankers better!

Oklahoma Bankers Association We make bankers better!