In This Issue…

- From Adrian’s desk …

- FinCEN to eliminate ‘obsolete’ BSA civil penalty rule

- CFPB to abandon enforcement of pair of rules

- ELT updates now live

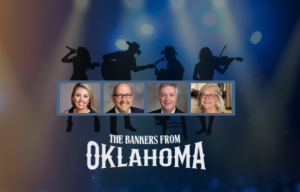

- ‘The Bankers From Oklahoma’ are back! OBA Convention registration opens!

- OBA education corner …

From Adrian’s desk …

By Adrian Beverage

OBA President & CEO

Just some random tidbits that might be of interest to our bankers this week!

• • •

I have a small favor to ask that would mean a lot to myself, as well as my family.

This past weekend, my dad, Roger, turned 80! We are going to celebrate the milestone this upcoming weekend so the entire family can be there.

Dad’s as healthy as he’s ever been in the last 20 years, and he’s got a couple of side gigs so he doesn’t get bored … although mom isn’t opposed finding more work to keep him busy! After every meeting I attend, he always calls and asks how all of you, Oklahoma’s bankers, are doing. I end up going down the list to give a report on everyone. I always tell him to reach out as a lot of people would love to hear from him, but he’ll never do it because he knows bankers are busy and he doesn’t want to be a bother.

The favor I ask is is this: If you wouldn’t mind taking a few minutes to send me an email with a story or memory that you have of dad, I’ll collect them and we’ll give them to him next weekend at his party. I know he’ll get emotional when he reads them and it’ll be something he’ll remember forever.

Our family appreciates your friendship more than you will ever know.

• • •

I’m with a LARGE group of bankers with our Contact Banker Program this morning! I’m excited to see so many take part in this invaluable program, to get a chance to meet with their legislators at the State Capitol and get a sneak peek on what we do during every session!

There’s one more Contact Banker Program day remaining, on April 29. Get signed up and I hope to see you at the Capitol!

• • •

Convention registration officially opened last week! If you’re not already signed up, I encourage you to do so as soon as possible. We have another great lineup for everyone, and, as always, part of the fun is getting a chance to see everyone! After all, The Bankers From Oklahoma are back in town!

• • •

Well, basketball season is finally over, so we turn now to baseball and softball. A name many of you will remember – Jordy Bahl – is having a season for the ages for my ‘Huskers! The erstwhile Sooner leads Nebraska in both pitching AND hitting!

FinCEN to eliminate ‘obsolete” BSA civil penalty rule

The Financial Crimes Enforcement Network plans to rescind one of its two rules establishing civil penalties for certain Bank Secrecy Act violations, which it said was made obsolete under a 1990 law adjusting the penalties for inflation.

The Treasury Department today published a list of rules and regulations that are “no longer necessary” as part of an executive order by President Trump directing agencies to eliminate “unlawful” regulation. Among the regulations to be rescinded is a FinCEN rule setting monetary penalties for certain BSA reporting and record-keeping violations by financial institutions.

The Treasury Department said the rule was made redundant by the Federal Civil Penalties Inflation Adjustment Act of 1990, and a second FinCEN regulation codifying the annual inflation-adjusted civil penalties mandated by the Act. The newer inflation-adjusted penalties are applied to all violations after Aug. 1, 2016.

CFPB to abandon enforcement of pair of rules

The Consumer Financial Protection Bureau, in the past week has vacated and/or abandoned enforcement of a pair of rules.

On Monday, the CFPB reached an agreement with the American Bankers Association and other plaintiffs to settle a lawsuit over its rule on credit card late fees. The CFPB last year issued a final rule to lower the safe harbor dollar amount for late fees to $8, eliminate a higher safe harbor dollar amount for late fees for subsequent violations of the same type, and eliminate the annual inflation adjustment for the safe harbor amount that was provided by the Federal Reserve in 2010. ABA joined the U.S. Chamber of Commerce and other plaintiffs in challenging the rule in U.S. District Court for Northern Texas, arguing the bureau exceeded its statutory authority.

Under the terms of the settlement, the bureau acknowledged it exceeded its authority under the Credit Card Accountability Responsibility and Disclosure Act, and that the late fee rule violates the Administrative Procedure Act. The parties asked the court to vacate the final rule. The judge must approve the agreement.

Additionally, the Bureau said last week it would not enforce a Biden-era rule requiring certain non-bank lenders to register information about their company with the bureau along with any agency or court orders concerning consumer protection violations.

The 2024 rule requires nonbanks to report information to the CFPB, which would be made available through a public registry. In a brief statement on Friday, the bureau said it will not prioritize enforcement or supervision actions with regard to entities that do not satisfy future deadlines under the regulation.

ELT updates now live

Service Oklahoma has officially launched several key upgrades to the Electronic Liens and Titles system, continuing our work to modernize vehicle services and improve the experience for lienholders, dealers, licensed operators and customers statewide.

What’s New

- Expanded Vehicle Information Access – Lienholders and dealers now have access to additional vehicle details through OkCARS, supporting faster, after-hours decision-making.

- Electronic Lien Placement by Dealers – Dealers can now electronically add liens for any lienholder directly through their OkCARS accounts. This enhancement expands existing functionality for financial institutions and helps streamline processes, reduce paperwork delays and increase overall efficiency.

- Electronic Title Bill of Sale – Vehicles with electronic titles will now transfer ownership using a new, notarized bill of sale form, available on the Service Oklahoma website.

Full Transition to Electronic Titles on July 1

Beginning July 1, all titles will move to electronic format, with limited exceptions. Paper titles issued prior to that date will remain valid until the next transaction, at which point they will convert to electronic.

Resources to Support You

Service Oklahoma sends regular updates to current lienholders. If you’re not already receiving those emails and would like to be added to the distribution list, contact the team at eltaccounts@service.ok.gov.

Here are a few additional resources to support you now:

- FAQs – Answers to common questions about these changes

- Training Guide – Step-by-step instructions for lien placement in OkCARS

- Demo Video – Watch the recorded walkthrough of the new features

- Contact Service Oklahoma – Reach the team directly at eltaccounts@service.ok.gov

‘The Bankers From Oklahoma’ are back! – OBA convention registration opens!

Join us in Oklahoma City this May for the can’t-miss event of the year – packed with valuable sessions, networking and a chance to reconnect with Oklahoma’s banking community. Whether you’re looking to expand your knowledge or simply enjoy a great time with fellow professionals, this event has something for every banker.

The connections are real, the conversations are waiting and your name tag is practically begging for a lanyard. We may not have fiddles or guitar solos, but we do have the ultimate gathering this side of Stillwater. Register now to secure your spot!

May 12-14, 2025

The Skirvin Hilton

1 Park Avenue

Oklahoma City, OK 73102

*Due to pricing structure online registration is not available.

OBA education corner …

The Boys From Oklahoma made their much-anticipated appearance in Stillwater last week! The opportunity to hear classic songs from the reformed Cross Canadian Ragweed and Turnpike Troubadours, alongside other red dirt legends like Stoney LaRue and Jason Boland, was a thrill many won’t forget! While tapping your toes to 7 & 7, make sure to take part in some upcoming continuing education opportunities for you and your staff in the coming weeks!

- Frontline Excellence (formerly known as Essential Teller) Seminar, April 22-Oklahoma City; April 23-McAlester; April 24-Tulsa — These seminars are programs that cover five pivotal modules for today’s frontline professionals. They serve as an important reminder about the significance of their role, serving as the CEOs of the customer experience and reinforcing the importance of their actions and reactions as a reputation builder for your brand.

- Understanding the Role of the Notary Public, April 24, webinar — In this webinar, you’ll learn about Notary Public responsibilities and notarial acts, basic laws and liability.

- Security Awareness Training: Best Practices for Keeping your Employees Engaged, April 28, webinar — It’s time to shift our thinking when it comes to security awareness training. Yearly education and testing just doesn’t cut it in today’s cyber world.

- Advanced Commercial Lending Workshops, May 1-Advanced Cash Flow Analysis, May 2-Advanced Tax Analysis, Oklahoma City — The cash flow analysis seminar will explore multiple models of both business and personal (business owner) cash flow analyses. Meanwhile, the tax return analysis seminar will provide the banker with several advanced tax return concepts and related analyses to help them more effectively work with their business customers.

- Managing All Aspects of Debit Cards, May 1, webinar — This session is specifically designed to explain the regulatory compliance requirements for issuing, servicing and managing the institution’s debit card product along with internal control and fraud prevention tips.

Oklahoma Bankers Association We make bankers better!

Oklahoma Bankers Association We make bankers better!