The Biden Administration and House leaders released the framework and legislative text of the Build Back Better plan in late October, and the package does not contain any language on the tax information reporting proposal opposed by the ABA, OBA and other state bankers associations. Please note, however, the release of the framework and text is only a part of …

Read More »Jeremy Cowen

80% of borrowers expected to be profitable in 2021 according to Ag Lender Survey

According to the Fall 2021 Agricultural Lender Survey report produced jointly by the American Bankers Association and the Federal Agricultural Mortgage Corporation, better known as Farmer Mac, agricultural lenders expect 80% of their borrowers to be profitable in 2021, with 70% profitable through 2022. The majority of ag lenders (69.7%) said overall farm profitability grew in the previous year for …

Read More »OBA robbery training video available; info on ATM jackpotting

As the year barrels toward its end, we listened to our bankers and heard the need for a tool for robbery training. All banks have their own policies, as they should, and those are usually always clearly communicated to staff. To enhance your training, we have recorded a half-hour Zoom training that includes the basics and best practices on which …

Read More »Week of Nov. 15

In This Issue… Federal court issues nationwide stay of vaccine mandate 2021 Oklahoma Bankers Hall of Fame ceremony set for Dec. 2 OBA to offer various surveys for bank use in 2022 OBA education corner … Federal court issues nationwide stay of vaccine mandate The ABA Banking Journal has reported a federal appellate court on Friday imposed a nationwide stay …

Read More »Consumer Prices Rise in October

According to the U.S. Bureau of Labor Statistics, the Consumer Price Index climbed 0.9% on a seasonally adjusted basis in October. The all-items index has risen by 6.2% in the last year. In October, the food index grew by 0.9%, the same as in September. After climbing 1.2% in September, the index for food at home gained 1.0% in October. The increase …

Read More »Elaine Fraud Training _ November 2021

Week of Nov 8.

In This Issue… Acting comptroller discusses climate change risk Thank you to our Bankers’ Night Out sponsors OBA partners with Office Depot for association member discounts OBA welcomes new strategic member OBA education corner … Acting comptroller discusses climate change risk Acting Comptroller Michael Hsu said this week the OCC expects to handle climate change risk regulation by the end …

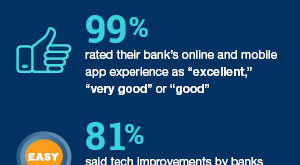

Read More »99% of consumers give high marks to their bank’s online sectors for second consecutive year

According to a national survey conducted by Morning Consult on behalf of the American Bankers Association, 91% of consumers evaluated their bank’s online and mobile app experience as “outstanding,” “very good,” or “good,” tying last year’s record. Furthermore, 81% of those polled believe that bank innovation and technical advancements are making it easier for all Americans to obtain financial services, demonstrating …

Read More »Cryptocurrency, ransomware make for dangerous combination

It’s hardly shocking increased use and recognition of cryptocurrency creates new opportunities and challenges for banks. What might surprise you, though, is exactly how the emergence of virtual currency is leaving financial institutions more vulnerable to an all-too-common problem: ransomware. According to the Financial Crimes Enforcement Network, the total U.S.-dollar value of ransomware-related transactions reported during the first half of 2021 …

Read More »Week of Nov. 1

In This Issue… OBA dues invoices being sent this week 2022 Reg. Z dollar thresholds announced CFPB issues guidance to assist with Reg. F compliance OBA education corner … OBA dues invoices being sent this week The annual dues invoices from the OBA are being sent to all our member banks this week. Strategic member dues invoices are also being …

Read More » Oklahoma Bankers Association We make bankers better!

Oklahoma Bankers Association We make bankers better!