Service Oklahoma is making key improvements to vehicle titling processes to enhance security, improve efficiency and simplify transactions for financial institutions, dealers and lienholders. The most significant updates include: Electronic Lien Placement for Dealers — Beginning April 7, 2025, dealers will have the ability to add liens electronically through their OkCARS account, making the process faster and more streamlined for …

Read More »Homepage News

FDIC signage compliance deadline pushed back to 2026

The FDIC board on Monday pushed back by more than a year the compliance date for certain provisions of the agency’s revised rule on the use of its name and logo by financial institutions, saying it will use the time to consider adjustments to the regulation. The FDIC last year adopted new requirements, originally setting a compliance deadline of Jan. 1. The …

Read More »2025 OBA Senior Management Forum Begins in April

April 6-8, Indian Wells, California Looking to connect with peers who understand the challenges of senior bank management? The 2025 OBA Senior Management Conference is the perfect opportunity to exchange ideas and address common industry issues. Attendees will be surrounded by those with similar titles, similar workloads, similar problems and likely solutions to issues that can be just as similar. …

Read More »OBA Bankers’ Night Out programs ready for spring

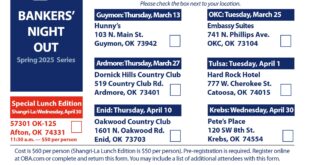

The dates for the OBA Bankers’ Night Out programs have been finalized. Mark your calendar for the date of the program that’s in your area of the state and plan to attend. Bring your coworkers with you so that everyone can be up to speed on the most recent developments affecting their job. In addition to state and federal legislative …

Read More »TRID, Flood education programs postponed

Due to the winter weather forecast for this week, the TRID and Flood education programs have been postponed. TRID will move to April 22. Flood will move to April 23. We apologize for an inconvenience. Feel free to contact the education department if you have any questions.

Read More »Bankers at state capitol: Register for OBA’s 2025 Contact Banker Program

We have set the dates for the 2025 Contact Banker Program: March 11, March 25, April 15 and April 29. 9 a.m. – Briefing at Capitol Noon – Depart Capitol for lunch 1:30 p.m. – Adjourn On the date you select, there will be a short briefing before we start walking the halls of the Capitol. We will stay together …

Read More »OBA, ABA to host webinar on credit card program

Community banks understand the importance of having a payments relationship with their customers, but many banks do not have the staff, resources or appetite for risk to profitably manage a credit card portfolio. Recognizing the challenges community banks face in issuing and managing credit cards, the OBA and ABA have endorsed the agent credit card program of ServisFirst Bank. By …

Read More »Trump names chairs, acting heads of several agencies, departments

Immediately upon assuming office last Monday, President Trump designated several chairs and acting heads of agencies and departments. Among agencies relevant to financial services, Trump designated the following: David Lebryk, fiscal assistant secretary of the treasury and the highest career official at the Treasury Department, as acting secretary pending the confirmation of nominee Scott Bessent. FDIC Vice Chairman Travis Hill …

Read More »Unauthorized tap-to-pay fraud increasing

According to frankonfraud.com, there is a rise in donation “Tap to Pay” fraud where consumers are approached in a parking lot (Target, WalMart, etc.) by individuals (scammers) requesting a small donation to help with <insert any sob story>. The victims believe they are donating $10 or $20, but the scammer is manipulating the transaction and billing them for thousands. Technically, …

Read More »OBA, ABA to host webinar on national, state legislative issues

The OBA and the American Bankers Association will host a free webinar on Jan. 30, exclusively for Oklahoma bankers, to discuss the upcoming changes and opportunities presented at both the state and federal levels for the banking industry. New leadership coming to Washington presents many opportunities for the industry, and 2025 is certain to be a year of significant policy …

Read More » Oklahoma Bankers Association We make bankers better!

Oklahoma Bankers Association We make bankers better!