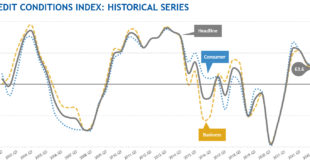

Bank economists expect credit conditions to continue improving for both consumers and businesses over the next six months, according to the American Bankers Association’s latest Credit Conditions Index released on Jan. 25. The latest summary of ABA’s Credit Conditions Index examines a suite of indices derived from the quarterly outlook for credit markets produced by ABA’s Economic Advisory Committee (EAC), which …

Read More »Homepage News

OBA Intern Program ready for 2022

An OBA program to be aware of is the OBA Intern Program. The Intern Program will be active in 2022 and we’re looking for participating banks! For more information on this IMPORTANT program – important not only to aspiring students, but also to participating banks – Contact the OBA education department at (405) 424-5252 or click here for more information!

Read More »Bankers at the State Capitol: Register for OBA’s 2022 Contact Banker Program

We have set the dates for the 2022 Contact Banker Program. Click here to find a sign-up form with the dates listed for this year’s program. We ask you select what dates work best for you and return your form to megan@oba.com. Once we have the groups finalized, we will send an email confirmation of your date. On the date …

Read More »Federal Reserve Bank of Kansas City Releases Fourth Quarter Energy Survey

The Fourth Quarter Energy Survey was released on Jan. 7 by the Federal Reserve Bank of Kansas City. The survey found that energy activity in the Tenth District climbed moderately from a quarter ago and increased further from year-ago levels, according to Chad Wilkerson, Oklahoma City Branch CEO and economist at the Federal Reserve Bank of Kansas City. Future activity …

Read More »Banks notice rise in fraud, associated costs in 2021

According to a new survey from LexisNexis Risk Solutions, banks experienced more monthly fraud attacks in 2021 than the previous year. The data determined that the average number of monthly fraud assaults for banks with annual turnover of more than $10 million has climbed from 1,977 to 2,320 since 2020. To read the full report from LexisNexis, click here.

Read More »FDIC chairperson announces resignation

FDIC Chairperson Jelena McWilliams announced her resignation today via a letter to President Joe Biden. McWilliams, a Republican, was named the 21st chairperson of the FDIC in June 2018 after being appointed by then-President Donald Trump. Her official departure has been set for Feb. 4, with FDIC board member Martin Gruenberg reported to become acting chairman – his third stint …

Read More »Merry Christmas, happy holidays from OBA!

The OBA staff wishes you and yours a merry Christmas and happy holiday season! Adrian Beverage | Joan Anderson | Jeremy Cowen | Elaine Dodd | Kathryn Donovan | Judy Hanna | Lea Ann Jackson | Debbie Leake-Morris | Megan McGuire | Nancy McKinnis | Payton Moody | Thi Pham | Janis Reeser | Niki Taylor | Sheila Wyatt

Read More »Small business optimism index increases in November

In November, the NFIB Small Business Optimism Index rose 0.2 points to 98.4. The Uncertainty Index fell 4 points to 63 points. Business owners intend to generate new employment at a seasonally adjusted net 25.0%, down 1 point from the previous month. The percentage of business owners who believe now is a favorable time to expand remained unchanged from the …

Read More »Supervisory Highlights Report Flags Mortgage Servicing, Fair Lending Issue

The Consumer Financial Protection Bureau (CFPB) today released a “Supervisory Highlights” report concentrating on examiner observations of different financial products from January to June 2021. Credit card account management, debt collection, deposits, fair lending, mortgage servicing, payday lending, prepaid accounts, and remittance transfers are among the areas where problems were discovered, according to the bureau. To read the full report, …

Read More »PPP loans prompt state-level employment growth

The Federal Reserve Bank of Cleveland determined in a new study brief this week that Paycheck Protection Program loans served to reduce the effects of the pandemic-related recession on state-level employment growth and had “substantial” advantages overall. Researchers discovered that providing one additional week of payroll support through PPP loans during the first round of PPP lending “would have minimized …

Read More » Oklahoma Bankers Association We make bankers better!

Oklahoma Bankers Association We make bankers better!