According to the Fall 2021 Agricultural Lender Survey report produced jointly by the American Bankers Association and the Federal Agricultural Mortgage Corporation, better known as Farmer Mac, agricultural lenders expect 80% of their borrowers to be profitable in 2021, with 70% profitable through 2022. The majority of ag lenders (69.7%) said overall farm profitability grew in the previous year for …

Read More »Homepage News

Consumer Prices Rise in October

According to the U.S. Bureau of Labor Statistics, the Consumer Price Index climbed 0.9% on a seasonally adjusted basis in October. The all-items index has risen by 6.2% in the last year. In October, the food index grew by 0.9%, the same as in September. After climbing 1.2% in September, the index for food at home gained 1.0% in October. The increase …

Read More »99% of consumers give high marks to their bank’s online sectors for second consecutive year

According to a national survey conducted by Morning Consult on behalf of the American Bankers Association, 91% of consumers evaluated their bank’s online and mobile app experience as “outstanding,” “very good,” or “good,” tying last year’s record. Furthermore, 81% of those polled believe that bank innovation and technical advancements are making it easier for all Americans to obtain financial services, demonstrating …

Read More »Proposed Rulemaking to Rescind the OCC’s June 2020 CRA Rule

The Office of the Comptroller of the Currency (OCC) responded to commonly asked questions (FAQ) about a notice of proposed rulemaking seeking public comment on a plan to revoke the OCC’s Community Reinvestment Act (CRA) regulation, which was issued on June 5, 2020. (June 2020 CRA rule). The notice, which was published in the Federal Register on September 17, 2021, …

Read More »U.S. Consumers Give Banks High Marks on Performance, Information Security

According to a new study done by Morning Consult on behalf of the American Bankers Association, nine out of ten Americans with a bank account are “extremely content” or “satisfied” with their primary bank, and 97% rank their bank’s customer service as “outstanding,” “very good,” or “good.” The poll, which was taken earlier this month and released Monday at the …

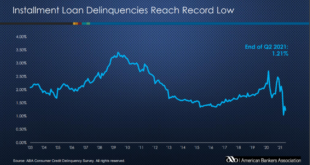

Read More »Consumer delinquencies hit new low in second quarter

According to the American Bankers Association’s latest Consumer Credit Delinquency Bulletin, consumer credit delinquencies hit a new low in the second quarter of 2021 as the economy continued to improve. When compared to the previous quarter, delinquencies decreased in nine of the 11 loan categories analyzed by ABA. In the second quarter, delinquencies on bank cards (credit cards issued by …

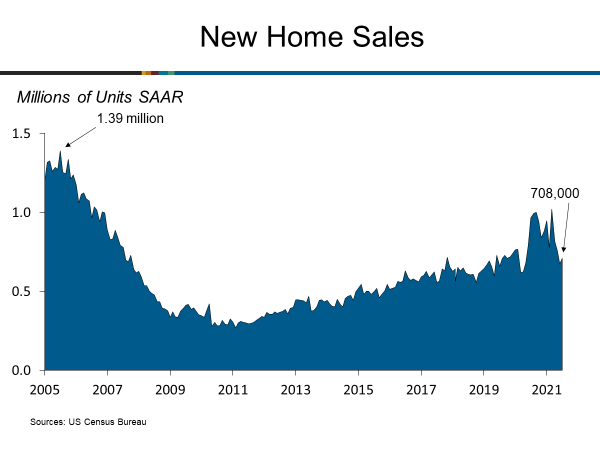

Read More »New Home Sales Rise in July

According to the U.S. Census Bureau and the Department of Housing and Urban Development, new single-family home sales increased to a seasonally adjusted annual rate of 708,000 in July. The June rate is 1.0% higher than the revised June rate of 701,000, but it is still 27.2% lower than the July 2020 forecast of 972,000. To read more about this story, click …

Read More »OBA president/CEO interviews on pair of Tulsa TV stations about IRS reporting proposal

OBA President and CEO Adrian Beverage appeared on two Tulsa TV stations this week to discuss the IRS reporting proposal and its possible negative ramifications. You can watch both video, as well as read the accompanying news stories by clicking the links below: FOX 23 – Sept. 29 KTUL – Sept. 30

Read More »Nondeductible portion of OBA dues calculated

The calculation representing the nondeductible portion of member dues attributable to lobbying expenditures has been made for the OBA’s year ending April 30, 2021. The source of the information used to determine this percentage included the Association’s general ledger and an estimate of the percentage of time related to applicable personnel’s involvement with lobbying activities by management of the Association. …

Read More »Oklahoma City banker pens op-ed in Oklahoman on IRS reporting proposal

NBC Oklahoma President and CEO H.K. Hatcher appeared as a guest columnist in The Oklahoman this weekend, opining on the proposed IRS tax reporting law. Hatcher wrote the proposal would “result in unnecessary costs to taxpayers and add an extensive amount of extra and unnecessary work for everyone involved – the IRS and our financial institutions.” You can read Hatcher’s …

Read More » Oklahoma Bankers Association We make bankers better!

Oklahoma Bankers Association We make bankers better!