NBC Oklahoma President and CEO H.K. Hatcher appeared as a guest columnist in The Oklahoman this weekend, opining on the proposed IRS tax reporting law. Hatcher wrote the proposal would “result in unnecessary costs to taxpayers and add an extensive amount of extra and unnecessary work for everyone involved – the IRS and our financial institutions.” You can read Hatcher’s …

Read More »Homepage News

Banking profits increase in second quarter

Despite the drop in net interest revenue, 64.1% of Oklahoma banks reported more net interest income than the previous year, according to the recently released Quarterly Banking Profile by the FDIC for the second quarter. For Oklahoma banks, the average return on assets was 1.24% in the second quarter of 2020, up from 0.36% the previous quarter. The FDIC reported …

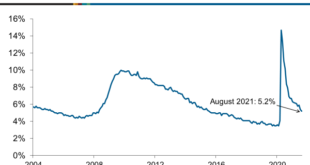

Read More »235,000 Jobs Added in August, Unemployment Rate at 5.2%

According to the Bureau of Labor Statistics, total nonfarm payroll employment increased by 235,000 in August. In August, the total number of unemployed people fell to 8.4 million, and the unemployment rate fell to 5.2%. Professional and business services, transportation and warehousing, private education and manufacturing accounted for the majority of employment growth in August. To read this story in its …

Read More »Advisory released on ransomware, wire fraud awareness for holidays, weekends

The Federal Bureau of Investigation and the Cybersecurity and Infrastructure Security Agency recently released a Joint Cybersecurity Advisory, urging businesses to defend themselves from ransomware threats during the holidays and weekends when most businesses are closed. Ransomware attacks and wire fraud with a high impact are most likely to occur just before holidays and weekends. Bankers should encourage their coworkers …

Read More »Survey Reveals Changes in Sales, Revenue, Capital Spending

According to the Federal Reserve Bank of Kansas City, the results of the Services Survey reflect changes in a variety of activity indicators, including sales, revenue, employment, and capital spending, as well as changes in input material and selling prices. Longer-term trends can be traced using the accumulated data. To read this article in its entirety from the Federal Reserve …

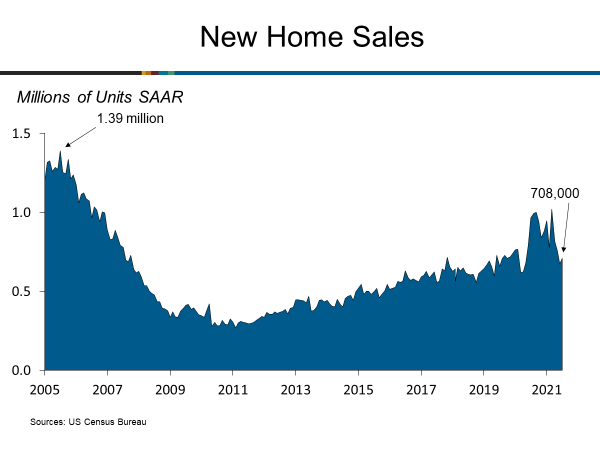

Read More »New Home Sales on the Rise in July

Despite an economic setback caused by the COVID-19 pandemic, the housing market is steadily recovering. According to the U.S. Census Bureau and the Department of Housing and Urban Development, new single-family home sales increased to a compounded annual growth rate of 708,000 in July. To read more about this story in its entirety from ABA Banking Journal, please click here.

Read More »Sudden Decrease in Satisfied Credit Card Users

Client satisfaction with credit card issuers fell this year as issuers attempted to accommodate customers’ demands amid ongoing economic uncertainty, according to the J.D. Power 2021 Credit Card Satisfaction Study. Satisfaction with national issuers has dropped considerably, down from 811 to 805 on a scale of 1,000. As a result, credit card issuers are searching for the causes of this …

Read More »Results compiled from OBA vaccine survey

The OBA sent out last week a short survey about the COVID vaccine and whether our member banks have, or plan to have, a mandate for their employees. We wanted to share the results of the non-scientific survey with our members. Here are the results: (answers | percentage of total answers) Q1: Does your bank have a COVID vaccine mandate …

Read More »OCC gives additional exam procedures for remittance transfers

The Office of the Comptroller of the Currency issued on Monday supplemental examination procedures on remittance transfers covered by Regulation E. The supplemental procedures align the OCC’s supervisory approach with amendments to Reg E by the Consumer Financial Protection Bureau that took effect July 21, 2020. The Reg E amendments permanently allow depository institutions to estimate certain fees and exchange …

Read More »SBA allows direct PPP forgiveness, bypassing banks

Politico reported today the SBA plans to outline a new initiative aimed at encouraging borrowers with loans of $150,000 or less — accounting for more than 90 percent of the pandemic-era program — to apply for loan forgiveness. According to the report, the SBA will notify banks that the agency is setting up its own online, consumer-facing forgiveness platform. Rather …

Read More » Oklahoma Bankers Association We make bankers better!

Oklahoma Bankers Association We make bankers better!