The American Bankers Association and a group of trade associations appealed a recent Texas federal court decision holding that the Consumer Financial Protection Bureau’s Section 1071 final rule did not exceed the bureau’s authority or violate the APA. The associations also moved the Fifth Circuit for a stay pending appeal. Section 1071 of the Dodd-Frank Act amended the Equal Credit …

Read More »Homepage News

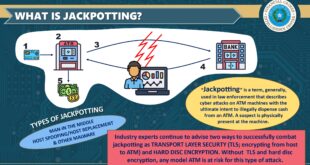

Jackpotting problem continues

We wanted to pass along another warning to our banks about how ATM jackpotting continues to be a problem in our area of the country and remains a serious threat. Jackpotting is gaining traction as ATMs in Van Buren, Arkansas, and Alma, Arkansas, were hit on Saturday These attacks allow the suspect to dispense cash from the ATM, without using …

Read More »OBA dues invoices to be sent

Just a quick little message to let our members know invoices for our annual dues will be sent out at the beginning of November. Each bank CEO, as well as the bank’s cashier, will receive a copy of the invoice. If you have any questions, don’t hesitate to drop us a line!

Read More »OBA, other state bankers associations ask for FCC action on illegal texts

The OBA, alongside 51 of its fellow state bankers associations last week, urged the Federal Communications Commission to issue new rules to help stem the flow of illegal texts and calls to consumers. The rules had been scheduled to be considered during the FCC’s meeting on Sept. 26 but were removed from the agenda two days before the meeting. The …

Read More »CFPB finalizes Section 1033 rule

The Consumer Financial Protection Bureau today issued its Section 1033 final rule, which deals with personal financial data rights. The rule will require financial institutions, credit card issuers and other financial providers to unlock an individual’s personal financial data and transfer it to another provider at the consumer’s request for free. The CFPB believes it will allow consumers to more …

Read More »Agencies announce thresholds for consumer credit, upper-level mortgage loans

The Federal Reserve and Consumer Financial Protection Bureau recently announced the dollar thresholds used to determine whether certain consumer credit and lease transactions in 2025 are subject to certain protections under Regulation Z, which implements the Truth in Lending Act, and Regulation M, which implements the Consumer Leasing Act. The agencies are required to adjust the thresholds annually based on …

Read More »FDIC considers extended deadline for rule on use of its signage by banks

The FDIC board will meet on Thursday to consider extending the compliance deadline for its final rule on the use of the agency’s name and logo by financial institutions. The FDIC last year adopted new requirements regarding the display of the official FDIC sign in banks and bank digital channels, setting a compliance deadline of Jan. 1, 2025. Earlier this …

Read More »More information given on EGRPRA process

During the OBA Washington Visit in September, the acting comptroller of the currency mentioned EGRPRA (The Economic Growth and Regulatory Paperwork Reduction Act), which elicited several questions from bankers. Ryan Portell, with the comptroller’s office, reached out to OBA Chair Alicia Wade late last week with some follow-up information. We’re sharing below what he had to say: The agencies have …

Read More »Four bankers to make up 2024 class for Oklahoma Bankers Hall of Fame

The Oklahoma Bankers Hall of Fame today announced the four bankers who will be inducted into its 2024 class later this year. Guy Berry III, Herschel Brewster, Brad Krieger, and Gregg Vandaveer will make up the 2024 class. The inductees were selected by a panel of bankers from across the state, and were voted on late last week. (The late …

Read More »Changes coming to counterfeit currency reporting

Effective Nov. 1, the U.S. Secret Service will no longer accept electronic submissions of suspected counterfeit notes via the USDollars website. The Registration and Submission option will be removed and no longer available. Open electronic submissions entered prior to Nov. 1, will be available to previously registered users. After Nov. 1, USDollars will continue accepting bulk submissions from banks currently …

Read More » Oklahoma Bankers Association We make bankers better!

Oklahoma Bankers Association We make bankers better!