Materials for the Feb. 26, 2025, meeting: Board Agenda Board Agenda Summary Exhibit A Exhibit B Entire packet as single file: Click here

February 2025

-

February 19, 2025

OBA Bankers’ Night Out programs ready for spring

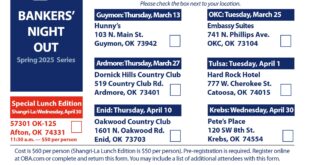

The dates for the OBA Bankers’ Night Out programs have been finalized. Mark your calendar for the date of the program that’s in your area of the state and plan to attend. Bring your coworkers with you so that everyone can be up to speed on the most recent developments affecting their job. In addition to state and federal legislative …

-

February 19, 2025

OBA Bankers’ Night Out programs ready for spring

The dates for the OBA Bankers’ Night Out programs have been finalized. Mark your calendar for the date of the program that’s in your area of the state and plan to attend. Bring your coworkers with you so that everyone can be up to speed on the most recent developments affecting their job. In addition to state and federal legislative …

-

February 17, 2025

TRID, Flood education programs postponed

Due to the winter weather forecast for this week, the TRID and Flood education programs have been postponed. TRID will move to April 22. Flood will move to April 23. We apologize for an inconvenience. Feel free to contact the education department if you have any questions.

-

February 14, 2025

Bankers at state Capitol: Register for OBA’s 2025 Contact Banker Program

We have set the dates for the 2025 Contact Banker Program: March 11, March 25, April 15 and April 29. 9 a.m. — Briefing at Capitol. Noon — Depart Capitol for lunch. 1:30 p.m. — Adjourn. On the date you select, there will be a short briefing before we start walking the halls of the Capitol. Please know, we will …

-

February 11, 2025

Bankers at state capitol: Register for OBA’s 2025 Contact Banker Program

We have set the dates for the 2025 Contact Banker Program: March 11, March 25, April 15 and April 29. 9 a.m. – Briefing at Capitol Noon – Depart Capitol for lunch 1:30 p.m. – Adjourn On the date you select, there will be a short briefing before we start walking the halls of the Capitol. We will stay together …

-

February 11, 2025

Week of Feb. 10

In This Issue… From Adrian’s desk … Funding to CFPB halts, future in question OBA, ABA to host webinar on credit card program Bankers at state Capitol: Register for OBA’s 2025 Contract Banker Program OBA TikTok Time … OBA education corner … From Adrian’s desk … By Adrian Beverage OBA President & CEO Just some random tidbits that might be …

-

February 6, 2025

Seaworthy Strategy

Seaworthy is a B2B modern marketing agency propelling Oklahoma banks through websites, branding, video, photography, and HubSpot/CRM services. We use strategic problem-solving and transformative design to deliver tangible results. Our clients love that we collaborate with them, custom-tailoring our services around their goals. We provide the quality and impact of a big agency with the attention and speed of a …

-

February 5, 2025

OBA, ABA to host webinar on credit card program

Community banks understand the importance of having a payments relationship with their customers, but many banks do not have the staff, resources or appetite for risk to profitably manage a credit card portfolio. Recognizing the challenges community banks face in issuing and managing credit cards, the OBA and ABA have endorsed the agent credit card program of ServisFirst Bank. By …

-

February 4, 2025

Week of Feb. 3

In This Issue… From Adrian’s desk … Chopra terminated as CFPB director; treasury secretary named acting director OBA, ABA to host webinar next week on credit card program OBA Emerging Leaders Book Club unveiled Review your bank’s info for upcoming Directory of Banks OBA Bankers’ Night Out programs ready for spring OBA education corner … From Adrian’s desk … By …

Oklahoma Bankers Association We make bankers better!

Oklahoma Bankers Association We make bankers better!