Image credit: Claude AI Info Given the omnipresent concern about cyber attacks targeting the banking industry, the FDIC, OCC and Federal Reserve recently published a new joint final rule establishing enhanced security incident notification requirements for banking organizations and their service providers. The final rule is designed to improve the sharing of information about cyber incidents that may impact the nation’s banking …

February 2022

-

February 4, 2022

Integrated Payment Services

Integrated Payment Services is a debit/credit card processor based in Oklahoma that is devoted to assisting banks in building a profitable portfolio, while providing exceptional products, equipment and local service. CONTACT INFORMATION: Contact: Tyler Carson & Dave Miley 1703 E Skelly Dr. Ste 105 Tulsa, OK 74105 Phone: (918) 492-7094, Cell: (918) 402-6766, eFax: (918) 517-3031 Email: tyler@ips-pays.com Email: dave@ips-pays.com Website: www.integratedpaymentservices.com

-

February 1, 2022

Week of Jan. 31

In This Issue… CFPB updates list of ‘rural or underserved’ counties for 2022 Compliance Update seminars in Oklahoma City rescheduled Review your bank’s information for upcoming OBA directory 2022 holiday closing signs available for purchase Bankers at the state capitol: Register for OBA’s 2022 Contact Banker Program OBA welcomes new strategic member OBA education corner … CFPB updates list …

January 2022

-

January 31, 2022

January 2022 OBA Legal Briefs

The FDCPA Regulation—Part 2 The CFPB’s Reg E FAQ—Part 1 Don’t Ignore the FDCPA Regulation (Part 2) By John Burnett Part 1 of our update on the CFPB’s Regulation F (12 CFR Part 1006), “Fair Debt Collection Practices Act,” appears in our November 2021 Legal Briefs. False, deceptive, or misleading representations or means To remain compliant with section 1006.18 of …

-

January 31, 2022

ATM jackpotting attacks continue in Oklahoma

We continue to hear from our bankers asking for more information on ATM jackpotting and MITM (Man-in-the-Middle) attacks in our state. A recent Texas Financial Crimes Intelligence Center Intelligence Brief (click here to download) contains updated details on the crime, as well as pictures from convenience store ATMs in Tulsa. A bit of good news is Oklahoma City Police Department recently …

-

January 31, 2022

Compliance Update seminars in Oklahoma City rescheduled

Due to the winter storm expected in our state, this week’s Compliance Update seminars in Oklahoma City have been rescheduled. The new date for the seminars is Thursday, Feb. 17, with the location still being the Harris Event Center at the OBA offices in Oklahoma City. If you have any questions about this change, don’t hesitate to contract the OBA’s …

-

January 27, 2022

Executive News: Happy new year as we prepare for busy 2022

Happy new year and welcome to 2022! I would encourage you to buckle up, as it looks like it’s going to be a busy year. I expect Washington to be as crazy as ever with possibly the most significant midterm election that we’ve seen in decades. Let’s not lose sight of everything that you as an industry accomplished in 2021. …

-

January 27, 2022

FDIC chairperson announces resignation

FDIC Chairperson Jelena McWilliams announced her resignation on Dec. 31 via a letter to President Joe Biden. McWilliams, a Republican, was named the 21st chairperson of the FDIC in June 2018 after being appointed by then-President Donald Trump. Her official departure has been set for Feb. 4, with FDIC board member Martin Gruenberg reported to become acting chairman – his …

-

January 27, 2022

Leverage ratio returns to 9% for new year

With the expiration of coronavirus-related relief provided under the CARES Act, the community bank leverage ratio will revert to a minimum of 9% starting on Jan. 1, 2022, the banking agencies said in late December. Banking organizations that elect the CBLR framework on their March 31, 2022, call reports will be subject to the requirement. “The community bank leverage ratio …

-

January 26, 2022

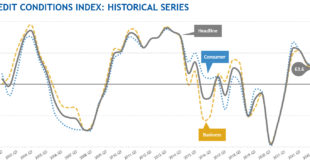

Credit market expectations for businesses, consumers confirm solid economic outlook

Bank economists expect credit conditions to continue improving for both consumers and businesses over the next six months, according to the American Bankers Association’s latest Credit Conditions Index released on Jan. 25. The latest summary of ABA’s Credit Conditions Index examines a suite of indices derived from the quarterly outlook for credit markets produced by ABA’s Economic Advisory Committee (EAC), which …

Oklahoma Bankers Association We make bankers better!

Oklahoma Bankers Association We make bankers better!