In This Issue… OBA dues invoices being sent this week 2022 Reg. Z dollar thresholds announced CFPB issues guidance to assist with Reg. F compliance OBA education corner … OBA dues invoices being sent this week The annual dues invoices from the OBA are being sent to all our member banks this week. Strategic member dues invoices are also being …

November 2021

October 2021

-

October 28, 2021

Proposed Rulemaking to Rescind the OCC’s June 2020 CRA Rule

The Office of the Comptroller of the Currency (OCC) responded to commonly asked questions (FAQ) about a notice of proposed rulemaking seeking public comment on a plan to revoke the OCC’s Community Reinvestment Act (CRA) regulation, which was issued on June 5, 2020. (June 2020 CRA rule). The notice, which was published in the Federal Register on September 17, 2021, …

-

October 28, 2021

Budget reconciliation package does not initially contain IRS reporting provision

The American Bankers Association reported today the Biden Administration and House leaders released the framework and legislative text of the Build Back Better plan. We are pleased to report after reviewing the package it does not contain any language on the ABA, state bankers association, banker and consumer-opposed tax information reporting proposal. Please note, however, the release of the framework and text is …

-

October 26, 2021

Week of Oct. 26

In This Issue… Report: IRS bank proposal to be dropped from budget bill Opposition to tax reporting proposal made clear by ABA, trade groups 2021 Oklahoma Bankers Hall of Fame ceremony set for Dec. 2 Bankers’ Night Out fall series continues with upcoming dates in Woodward, Lawton OBA education corner … Report: IRS bank proposal to be dropped from budget …

-

October 22, 2021

U.S. Consumers Give Banks High Marks on Performance, Information Security

According to a new study done by Morning Consult on behalf of the American Bankers Association, nine out of ten Americans with a bank account are “extremely content” or “satisfied” with their primary bank, and 97% rank their bank’s customer service as “outstanding,” “very good,” or “good.” The poll, which was taken earlier this month and released Monday at the …

-

October 19, 2021

Executive News: IRS reporting issue, OCC nominee highlight latest issues

Last month, we talked about the reconciliation bill being discussed in Congress, along with the IRS proposal. Fast forward one month and nothing has changed. No vote has been taken on reconciliation bill and no vote has occurred on the Senate infrastructure bill. Here’s a look at where we were and where we are at today. The $1 trillion Senate …

-

October 19, 2021

Week of Oct. 18

In This Issue… Democrats likely to scale back Treasury’s IRS bank reporting plan OCC releases updated LIBOR transition self-assessment tool Bankers’ Night Out fall series continues with upcoming dates in OKC, Woodward, Lawton OBA education corner … Democrats likely to scale back Treasury’s IRS reporting plan Senate Democrats will likely reveal a scaled-back version of a Biden administration proposal to …

-

October 18, 2021

Banking profits increase in 2021’s second quarter

Despite the drop in net interest revenue, 64.1% of Oklahoma banks reported more net interest income than the previous year, according to the recently released Quarterly Banking Profile by the FDIC for the second quarter. For Oklahoma banks, the average return on assets was 1.24% in the second quarter of 2020, up from 0.36% the previous quarter. The FDIC reported …

-

October 15, 2021

October 2021 OBA Legal Briefs

Regulatory priorities Consumer complaints 2021 OK legislation—Part III OK Banking Code Judgment liens Motor Vehicles OK Tax Code OK POA Act—Part II Uniform Consumer Credit Code (“U3C”) § 3-508A Uniform Interstate Depositions and Discovery Act of 2021 Regulatory Priorities By Andy Zavoina You spend your days preparing for meetings, going to meetings, auditing your bank for various compliance topics, …

-

October 14, 2021

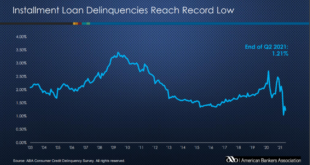

Consumer delinquencies hit new low in second quarter

According to the American Bankers Association’s latest Consumer Credit Delinquency Bulletin, consumer credit delinquencies hit a new low in the second quarter of 2021 as the economy continued to improve. When compared to the previous quarter, delinquencies decreased in nine of the 11 loan categories analyzed by ABA. In the second quarter, delinquencies on bank cards (credit cards issued by …

Oklahoma Bankers Association We make bankers better!

Oklahoma Bankers Association We make bankers better!